As Hawaii works through a host of complex interconnection issues, the solar industry is taking a fresh, new look at energy storage. Grid-connected storage has been around for years, promising a wide array of uses—from energy arbitrage and frequency regulation, to spinning reserve. It also has the potential to make a 100% renewable grid technically possible. Storage makes wind and solar “dispatchable,” so that clean energy can be used whenever it is needed. Viable technology options for storage exist today, and storage development is ongoing worldwide.

Given Hawaii’s small, isolated grids running oil-fired generation, Hawaii’s electric rates are the highest in the nation. With high rates, an abundance of sun, and plenty of aloha, it’s not surprising that Hawaii leads the nation in solar capacity per capita. But due to concerns about backfeed and voltage impacts, a non-export model is being considered that would prohibit export of a customer’s solar generation onto the grid.

Using storage to avoid exporting excess solar energy

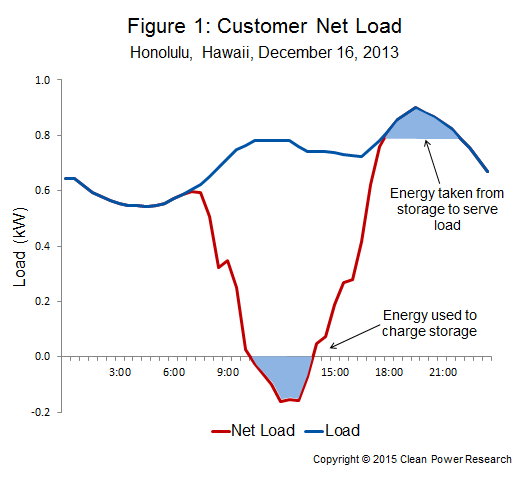

If Hawaii adopts a policy to prohibit export onto the grid, energy storage may play a role. The idea is simple. Figure 1 shows a sample net load curve for Honolulu on December 16, 2013.

The blue curve is the Hawaiian Electric load (Oahu island grid), scaled down to the size of the average Hawaiian residential customer (17 kWh per day, from EIA). Unlike most other states that exhibit different load shapes depending on the season, the load in Hawaii is fairly regular through the year. For purposes of illustration, this load shape is taken as a “sample customer” load in the discussion that follows. The red curve shows net load (load minus solar production) from a 2 kW system in Honolulu on that same day (based on SolarAnywhere irradiance data, and a photovoltaic (PV) system that is south-facing, tilted 20 degrees).

A customer with behind-the-meter solar generation can use the solar energy produced to serve load during the day. As shown in Figure 1, however, there are times when solar production from the 2 kW PV system exceeds the customer’s load. If the excess energy produced cannot be exported to the grid, corrective action would be necessary. Rather than “spilling” the excess energy by throttling back on the inverter, this energy could instead be stored in an onsite battery energy storage system.

Figure 1 illustrates the concept. The excess solar energy that would have been exported is diverted to storage by charging the battery. It is later discharged from the battery to serve nighttime loads. Using the stored solar energy is preferable because it’s “free,” rather than purchased grid electricity.

Storage via time independent loads

The concept described above invokes energy storage in the most commonly understood form: the electrochemical battery. However, storing energy in a battery is not the only solution. An alternative is to incorporate time-independent loads as much as possible.

For example, with a little intelligence built into the home’s water heater, it would be possible to heat water using solar energy for later use (see here for a comparison of PV to solar thermal for water heating and here for an update). Rather than firing up the water heater after the morning shower in order to maintain a fixed temperature set-point, the temperature could be allowed to drop to some lower, but still usable, level. Then, the hot water temperature could be raised to its set-point later in the day when solar energy is being produced.

Ideally, the tank would have sufficient insulation to eliminate the need for an early morning temperature boost, but even with a boost, the overall energy use would be primarily solar. This water-heating strategy makes most sense using a heat pump water heater with a high coefficient of performance and good insulation (as compared to a standard electric water heater).

Other time-independent loads are possible as well. The excess energy could be used to charge an electric vehicle or pre-cool a building.

Time-of-use rates versus standard rates

Conventional wisdom is that behind-the-meter storage benefits from time-of-use (TOU) rate schedules. These schedules provide electricity at lower prices during off-peak periods that can be used for charging the battery. During on-peak periods, when electricity prices are high, the battery can be discharged. Buy low, sell high, right?

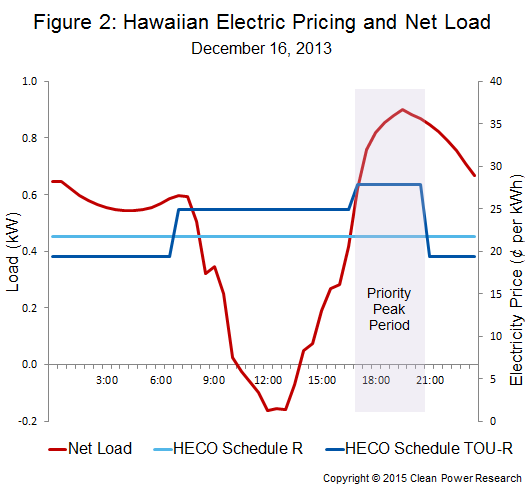

Well, maybe not. Figure 2 shows the net load (i.e., with solar as described above) for December 16, 2013, along with two alternative pricing schedules available to residential customers at Hawaiian Electric (the utility serving Honolulu). The light blue curve is the standard schedule, and the dark blue curve is the voluntary residential TOU schedule (taken from CPR’s PowerBill rates software).

To simplify this example, these curves do not build in fixed customer charges or the energy cost adjustment (which may be either positive or negative depending on the month’s fuel prices), but they do include base fuel and non-fuel prices. The curves are based on the lowest usage tier.

The TOU schedule shows a price of 27.9 cents per kWh during the schedule-defined “priority peak period,” but only 19.4 cents per kWh off-peak. This is an 8.5 cent difference that, at first glance, may seem like an attractive price differential. Even better: under the scenario described here, the storage is being charged by solar energy, not from the grid at the off-peak price. Therefore the charging price (once the investment in solar is made) is zero, and the price differential is even higher: the full 27.9 cents.

The problem with this reasoning is that the TOU is a voluntary pricing schedule. The customer can choose either the standard rate or the TOU rate. Most customers elect the standard rate, so the better on-peak reference price—at least for typical customers—would be the standard rate of 21.7 cents.

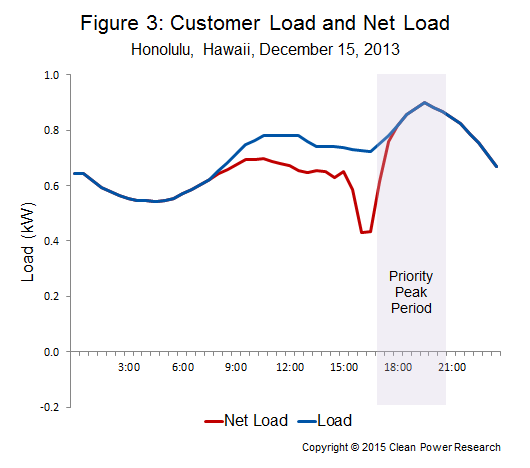

Furthermore, the customer could incur significant added costs on a TOU rate, especially on poor solar days. For example, Figure 3 shows the net load on December 15, 2013, one day before the previous figures. With the weak solar generation on this day, there was no “excess” energy available for charging. Consequently, the load in the priority peak period would have been served by the most expensive on-peak electricity from the grid.

Had the customer opted for the standard rate, the price to serve this load would have been just 21.7 cents, but the TOU price is 27.9 cents. Without stored solar energy available, the customer would have lost 6.2 cents per kWh by selecting the TOU rate option. Not only that, but even on a good solar day (Figure 1), the remaining load after the stored energy is used up is purchased at the higher price.

Charging from the grid

Standard flat rates do not provide an incentive to charge from the grid. In the scenario described in this article, the effective cost of charging storage off the grid using the flat rate of 21.7 cents is 27.1 cents. This is due to “turnaround” storage losses that are assumed to be 20% ($.217/(1-20%) = $.271). There is therefore no financial benefit to charging with grid power, especially when considering the loss of cycle life to the battery.

Under the TOU schedule, with a perfect forecast of solar and load, it theoretically would be possible to charge the storage with exactly the right amount of solar and off-peak grid energy to serve all of the peak load. This would make it possible to avoid high peak prices. However, there are two reasons not to do this:

- The size of the storage system would have to be increased significantly to handle the load, increasing the capital cost.

- The price levels still do not pencil out. Charging would be done with the off-peak price of 19.4 cents, but taking into account losses (again assuming 20%), this effectively costs 24.2 cents, which is higher than the flat price of 21.7 cents. In this scenario, it would be cheaper to stay with the standard schedule and use grid power to serve the load during peak hours. Even if this calculation were break-even, there would be a cost associated with lost life of the battery.

Conclusions

If a non-export scenario develops in Hawaii, energy storage may make sense as a means of avoiding spilling solar energy to prevent export. However, it may prove beneficial to first consider the use of time-independent loads, such as heat-pump water heaters and electric vehicles. Excess solar energy after these loads are served could be used to charge a stand-alone battery.

It would also be prudent to investigate further the use of TOU rate schedules in combination with storage. Does it make economic sense to switch from a standard, flat pricing schedule to a TOU? Does it make economic sense to charge the battery using off-peak energy under a TOU schedule? The simple analysis provided here suggests that at least in some cases it may not.

A more comprehensive analysis would incorporate real load profiles (rather than the simplified, scaled profile here), consider commercial customers as well as residential customers, and build in other scenarios and assumptions not considered here. But it may turn out that in some situations, TOU schedules do not offer a sufficiently high price break for off-peak charging relative to the standard rate, and they end up increasing on-peak customer costs, especially on poor solar days. For a customer with storage, it may not make sense to switch to a TOU rate.