Storage – A Highly Charged Market

One way to gauge hot topics in the utility world is to track what’s new on the DistribuTECH Conference agenda. Due to strong interest from utility attendees and the vendor community, the DistribuTECH Conference Committee decided to add a 15th track for the 2018 event: Energy Storage.

I serve on the committee that selected the presentations and panels for the new Energy Storage track, and we had a wealth of excellent abstracts to choose from. Submittals covered the full gamut of storage issues facing utilities, developers and consumers. Topics included everything from using storage for system resiliency to ancillary services to leveling the duck curve. Project types ranged from utility scale developments to residential behind-the-meter applications.

More evidence that storage is trending? The Solar Power International conference co-located with Energy Storage International this year, bringing together a growing community interested in the impacts of solar + storage.

Meanwhile, vendors are fine tuning their offerings, and starting to bundle them. A great example is the recent Vivint – ChargePoint – Mercedes-Benz Energy announcement of their Fully Integrated Residential Energy Management System. This offer bundles PV + Storage + EVSE. Obviously, Tesla is taking a very similar approach.

GTM Research, in their third-quarter 2017 U.S. Energy Storage Monitor executive summary, is projecting storage to grow by a factor of eleven between 2016 and 2022. GTM projects that over half of that growth will be behind-the-meter systems.

Storage Challenges and Opportunities

As storage offerings become more prevalent, utilities, developers and consumers will face some of the same challenges they have dealt with for other types of distributed energy resources (DERs):

- Progressive utilities will want to be a trusted advisor to their customers and will need to collect detailed project specs for system planning.

- Developers will want clear and transparent interconnection application processes.

- Consumers will want unbiased, personalized and easily consumable cost/benefit advice.

Fortunately, our solutions for DER engagement, incentive program management and interconnection application processing can be easily extended to solve these storage challenges. Let’s look at a couple of examples at the leading-edge of the storage evolution.

Hawaii

Over the past ten years, participation in solar generation programs in Hawaii grew from near zero in 2006 to more than 60,000 participants by the end of 2015. With adoption at these levels, Hawaiian utilities have reached the original caps set by the Hawaiian PUC for the Customer Grid-Supply (CGS) program to ensure stability on isolated island grids. The CGS program is scheduled to close October 21, 2017. After that, customers will still be able to install solar, but only under the Customer Self-Supply (CSS) program. Under CSS, customers cannot sell electricity back to the grid and most customers will need battery storage to offset a significant portion of their electricity use.

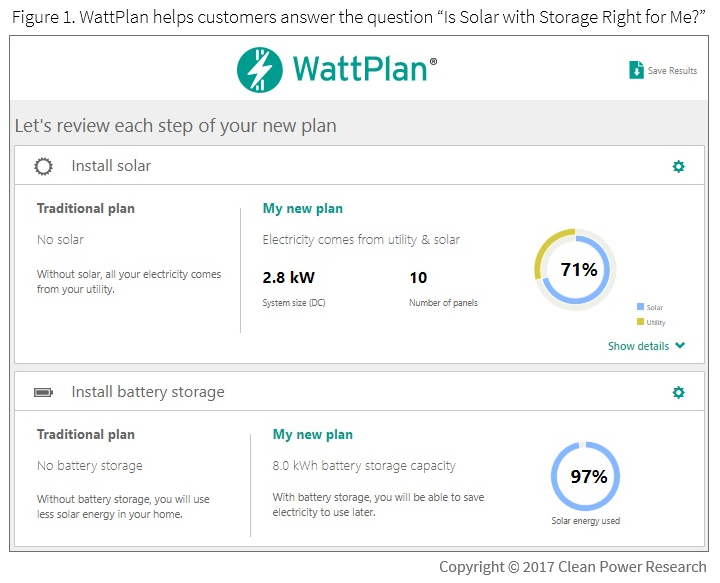

Hawaiian Electric Company (HECO) was already using WattPlan® to help their customers make informed decisions based on the costs and benefits of solar. As the CSS program took effect, Clean Power Research and HECO worked together to extend WattPlan to answer the question “Is Solar with Storage Right for Me?” Read more about this example here.

California

According to GTM Research, California is the leader in total number of storage projects, with about 40% of existing residential storage projects. Current state regulatory initiatives such as the DER Action Plan effort also point to continued growth of storage.

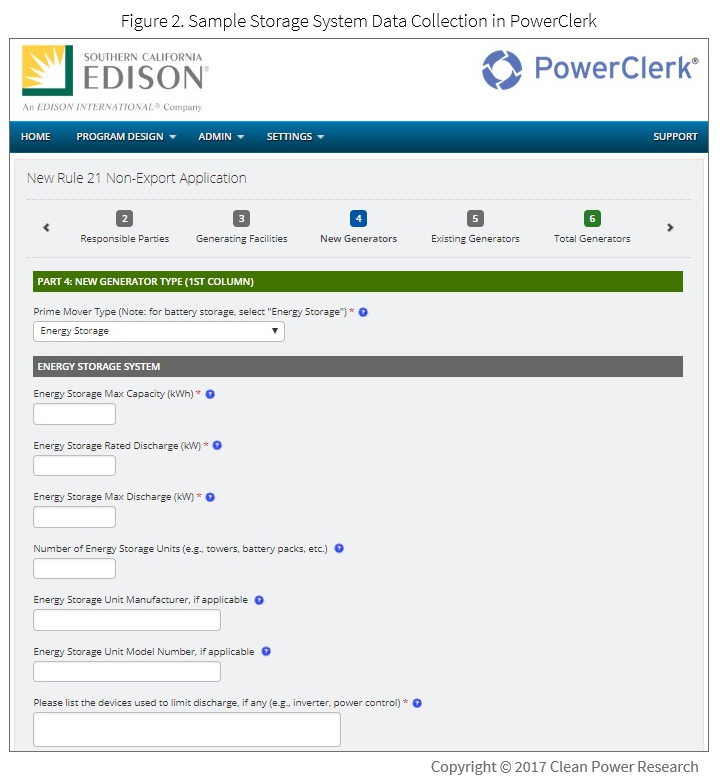

In the Southern California Edison (SCE) service territory, the study and interconnection of CPUC-jurisdictional generation (including energy storage operating in charge or discharge mode) is covered by SCE’s Tariff Rule 21. For storage projects, a developer submits a Rule 21 Non-Export Interconnection Request.

SCE first implemented PowerClerk® in 2015 to cover standard Net Energy Metering (NEM) 1.01 interconnection applications. Since the initial launch, SCE has deployed additional PowerClerk programs, including one for its Rule 21 Non-Export Online Interconnection Application Portal. For storage projects, the portal collects data such as maximum capacity, discharge rates and manufacturer specifications.

System planners, program managers and others can now access this data for further analysis.

Several of our utility customers are starting to use PowerClerk in similar ways to track storage interconnection applications, for both solar plus storage and standalone storage projects

Looking Ahead

Over the past several years, we have helped more than 30 proactive utilities plan and manage new solar and renewable generation on their systems with our cloud-based solutions WattPlan, PowerClerk® and SolarAnywhere®. For our utility customers, storage becomes just one more type of DER they can add to their programs.

Our Consulting team also supports program and system planners by performing customized studies of distributed energy resources, developing load shaping strategies and delivering forecasts of customer adoption.

Stay tuned for future posts covering the convergence of DER programs and solutions.

1The NEM 1.0 program was recently superseded by the NEM 2.0 Interconnection Online Application System.