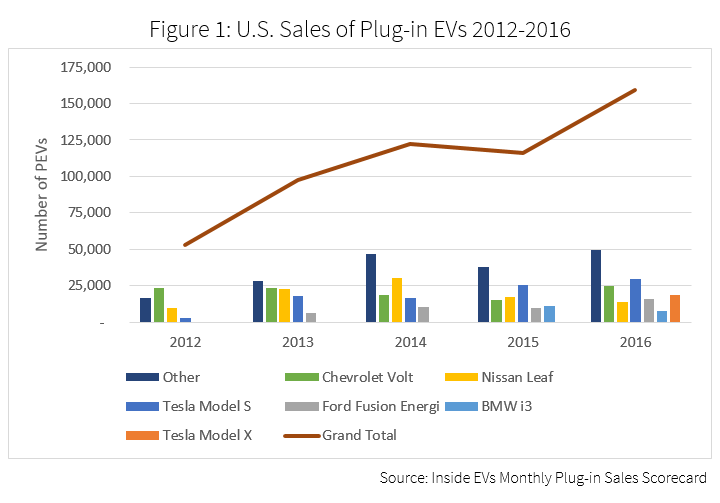

In 2016, electric vehicle (EV) sales grew 37% and utilities initiated strategies for dealing with that growth. Six utilities and state energy agencies now use WattPlan® to provide customers with personalized and objective guidance to their EV related questions. Evidence in 2016 points to EV sales and utility action accelerating in 2017: The year of the long range EV.

Range matters

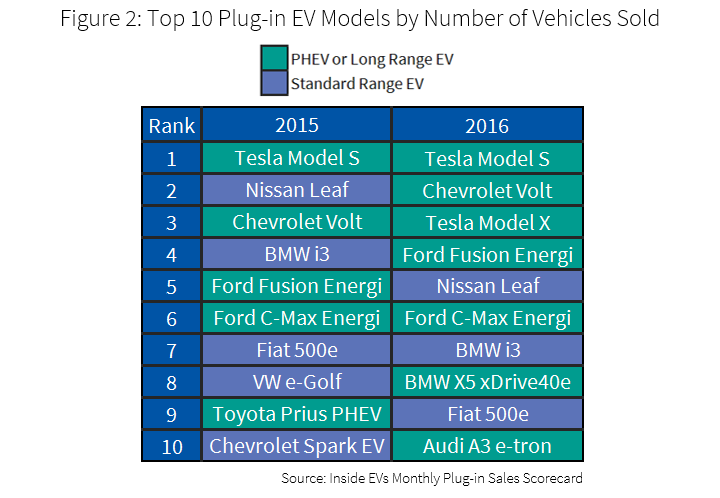

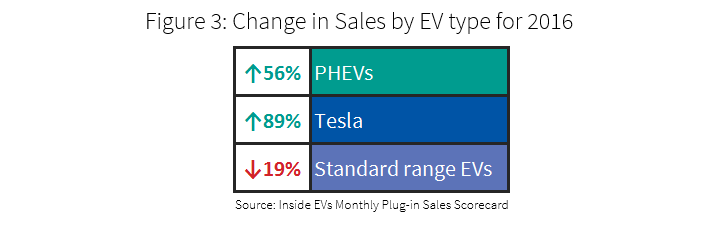

In 2016 it was clear that consumers care (a lot) about range. Plug-in hybrid electric vehicles (PHEVs) and long-range EVs (i.e., vehicles that address range anxiety) accounted for 100% of EV market growth. In 2016, market share dropped for all five standard-range (100-mile or less), non-hybrid EVs that were top 10 in sales in 2015.

Worse than the market share decline, in 2016 four of the top five standard range, non-hybrid EVs saw a decline in sales despite substantial overall market growth (only the Chevrolet Spark saw an increase in sales).

Market intrigue and press focused almost entirely on range as well. In 2016, we saw reveals for the Tesla Model 3 and the Chevy Bolt, the first affordable long range EVs. The Model 3 saw 400,000 reservations in 2016, and the Bolt was named 2017 Motor Trend Car of the Year. It’s the third EV to ever win this award (previously, Chevrolet Volt won in 2011, and the Tesla Model S won in 2013).

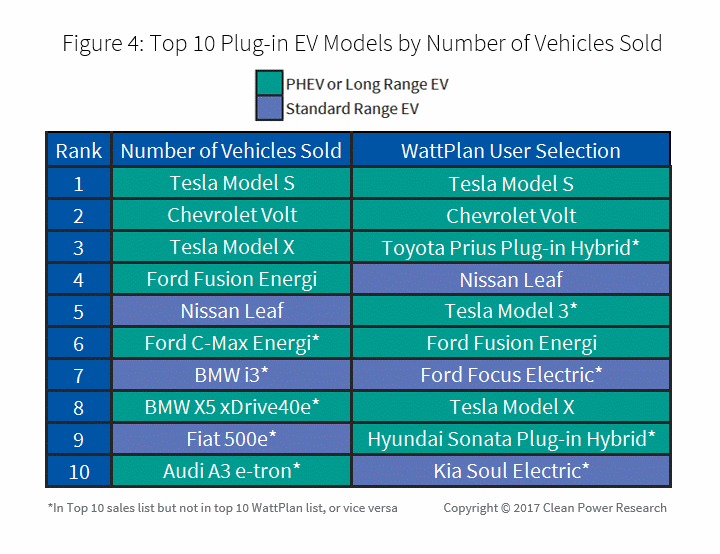

Looking at the most commonly compared vehicles among WattPlan users, we can see further evidence of high interest in long-range EVs and PHEVs.

Not shown in the table above is the Chevy Bolt, which was added to WattPlan in late in 2016, and in the last 2 months alone, has already climbed into the top five most selected EVs.

Utilities initiate EV strategies by engaging customers

Low oil prices and consumers waiting for new models were blamed for declining sales in 2015. Average oil prices continued to decline in 2016 though, and 2016 models of popular EVs like the Nissan Leaf and the Chevy Volt featured marginal range improvements.

The attention garnered by new Tesla and Chevy EVs likely helped drive some of the growth in 2016. Another big change in 2016 was initiation of EV strategies by utilities. We hinted that in 2016, utilities would begin initiating EV strategies by engaging customers and filling the education gap left by auto dealers. Building on our initial launch with Salt River Project, three new utility customers began advising customers about their EV options with WattPlan in 2016: SMUD, Austin Energy and Hawaiian Electric.

2017: The year of the affordable long range EV

With the widely-covered Tesla Model 3 and Chevy Bolt hitting the streets in 2017, EV sales will likely continue to grow with a strong focus on range-anxiety-relieving vehicles. By the end of 2017, there may be as many as six manufacturers worldwide offering long range EVs with ranges greater than 150 miles. Many others will offer long-range PHEV models, and EVs with ranges exceeding 100 miles.

In 2017, look for more utilities to begin engaging customers about their EV options as they execute their EV strategies. The growth trajectory for EVs is undeniable, and the benefits of EVs are becoming clearer to utilities. Customer interest in combining EVs, rooftop solar and other distributed energy resources (DERs) is also growing, so look for utilities to begin complementing their WattPlan for EV implementations with the ability to analyze other technologies.

Get a WattPlan Demo

Interested in seeing how you can use WattPlan to better engage customers and improve utility customer satisfaction? Request a 15-minute demo, where you’ll see how WattPlan is transforming the way utilities are educating and engaging customers.